Changes in the Polish tobacco market are accelerating! Despite high inflation and rising prices, the grey zone in this sector is shrinking. Is this influenced by the growing popularity of alternative tobacco products such as e-cigarettes?

Some time ago we wrote about the coffee habits of Poles: https://perfecta-retail.com/how-do-poles-drink-their-coffee/. Today, we are going to talk about another extremely popular stimulant – tobacco products. And there is much to write about, as changes in the Polish tobacco market are gathering pace!

Some statistics

First and foremost, around 18% of Poles, mainly men, admit to using tobacco. According to Eurostat data, this puts us roughly in the middle of the European pack.

Swedes smoke the least cigarettes in the EU (6.4%) and Bulgarians the most (28.7%). More statistics can be found here: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Tobacco_consumption_statistics#Daily_smokers_of_cigarettes

According to the latest research by NielsenIQ, Poles will spend PLN 29.5 billion on traditional cigarettes in 2022, which translates into almost 40 billion individual cigarettes! This means that the category continues to grow!

Interestingly, this increase is not driven by rising prices. Tobacco consumption is simply increasing. The number of cigarettes sold increased by more than 5% last year. Although it may seem counterintuitive, Poles are smoking more and more!

It is worth pointing out that this upward trend has been going on for years, and is therefore unrelated to the ongoing war in Ukraine and the influx of millions of refugees from across our eastern border into Poland since 2022.

Traditional cigarettes are still the most important category (over 80%) among tobacco products in small-format shops, newsagents and kiosks.

Changes in the Polish tobacco market – novelty products

Alongside the increase in sales of traditional cigarettes, sales of so-called novelty products such as e-cigarettes and tobacco heaters are growing rapidly in the market. The annual sales of the former amount to PLN 780 million, and the latter to PLN 3.6 billion!

This is really rapid growth, as the market for tobacco warmers has been expanding in Poland since 2017, when the IQOS devices offered by Philip Morris went on sale. According to estimates, by the end of 2022, approximately 10% of Polish smokers will be using this type of device.

E-cigarettes, i.e. systems based on special liquid mixtures heated electronically, have been on the market for longer. It is estimated that in large cities, the market share of novelty products may be as high as 25%, and today’s e-cigarette market in Poland may be worth as much as PLN 2 billion.

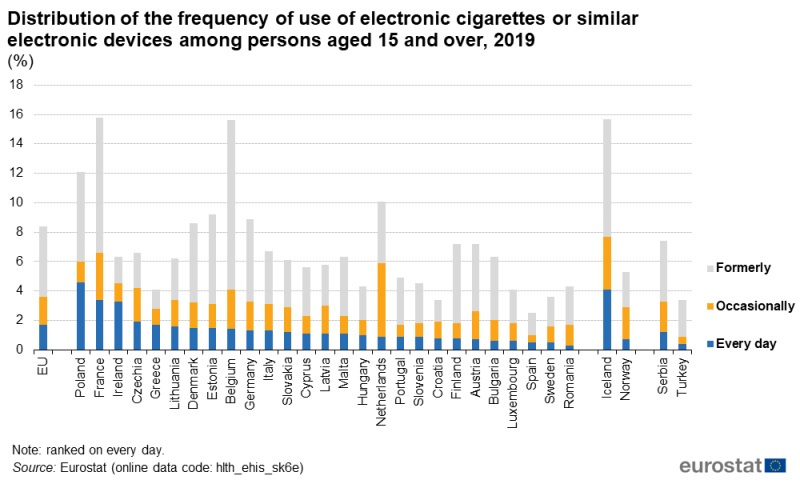

Interestingly, compared to other EU countries, Poles appear to be particularly open to tobacco “novelties”. The 6% vapers in the general population gives us second place in the EU after France (6.6%) and before the Netherlands (5.9%).

However, we are second to none when it comes to the percentage of people who use novelty products on a daily basis. Almost 5% of us do so! This is followed by the Irish, the Greeks, the French, and the Portuguese.

Conclusions

As we can see – despite widespread anti-smoking campaigns – smoking and vaping is on the rise in Poland and there is no sign of this trend reversing any time soon.

As a producer of retail furniture, Perfecta has been producing special racks for the sale of tobacco products for many years. Products such as REVO or Perfect.ONE are present in shops in many markets in the European Union and beyond.

Their advantages have been recognised, among others, by JTI (Japan Tobacco International), with whom we have been cooperating for years.

Perfecta also has a range of cigarette dispensers on offer. Their innovation has been appreciated by, among others, the large Polish retail chain Dino.

So, although their harmfulness is widely known, tobacco products still form a significant part of the Polish FMGC basket. Poles love the smoke and – for the time being – have no intention of giving it up! We are also open to novelties and are not afraid of innovations. A wise manager will know what to to with this information!